Life happens.

We can help.

Join the millions of people who choose to shop now, pay later with Snap Finance. No credit needed.1

Finding a store is your easy first step.

Won’t affect your FICO® score to apply1

How Snap works

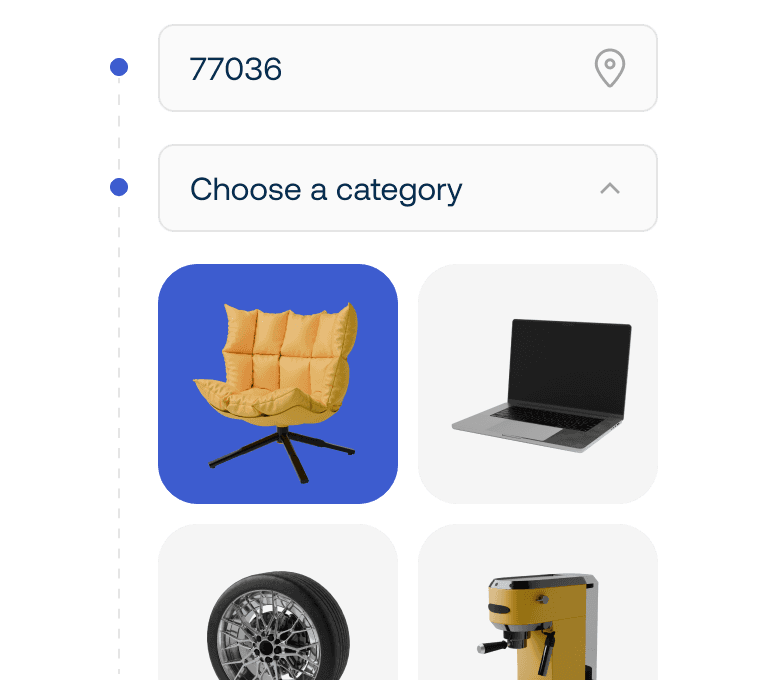

Find a store

Start by adding your ZIP code in our Store Locator. You can search by the name of the store or browse shopping categories for locations that offer Snap.

Apply

Apply online in minutes, get a decision in seconds. Be prepared to answer a few questions about you and your finances.

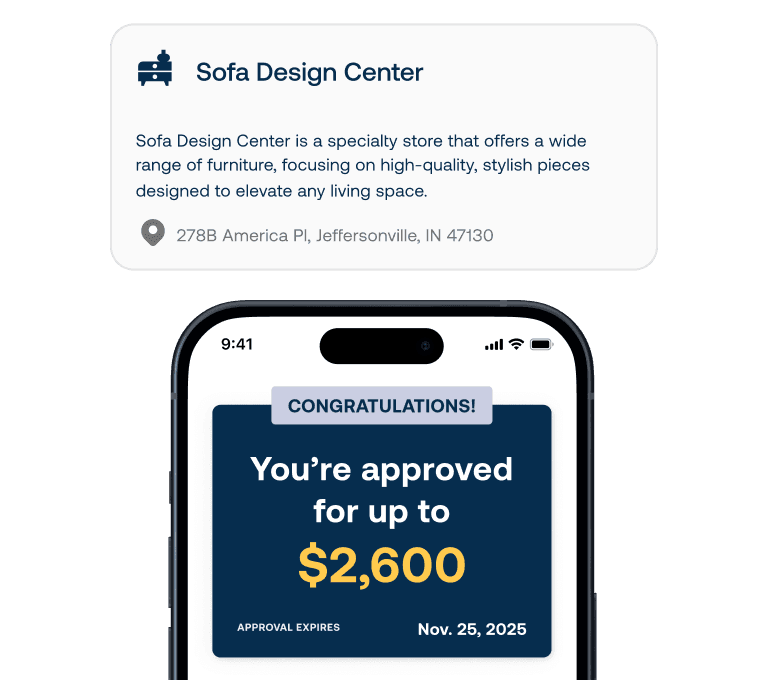

Shop

If approved, use your approval amount at the retailer you’ve chosen, online or in-store. Your approval amount may be up to $5,000.2

All you need to apply

Be old enough to enter into a legal contract

Steady monthly income of at least $750 or $1,000, depending on product

Active checking account

Valid email address and smartphone number

Snap has your back with approval amounts that range from $300 - $5,000. Complete an in-store application at participating locations or apply online now with no impact to your FICO® score.1

With lease-to-own financing, Snap purchases the merchandise upfront so they own it. You take it home and lease it from Snap until you make all your payments. Then it’s yours. It’s that simple.

What are you shopping for?

Over 150k+ shops. Shop by category.

Answers to your questions

How do I apply for Snap Finance?

Our application process is simple, and you get a notification of a decision in seconds. You can:

Apply online at snapfinance.com or through the Snap Finance Mobile App (IOS or Android).

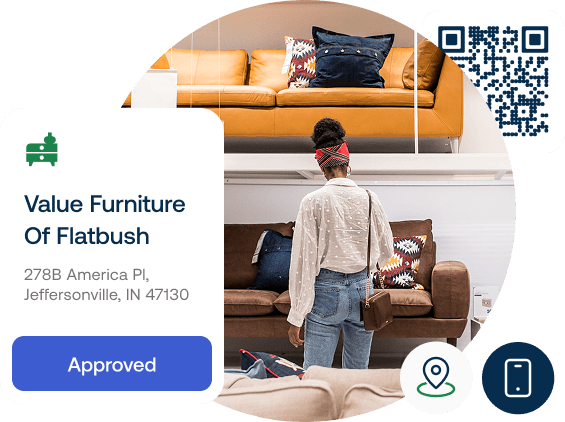

Apply in-store at a Snap Partner through our text-to-apply feature on your smartphone or with the help of a sales representative. We have thousands of stores that offer Snap.

Apply and check out online with our select E-commerce Snap Partners.

Where can I use Snap Finance?

Snap Finance can be used at thousands of participating Snap Partners. Use our Store Locator to find a participating retailer near you or online.

What types of things can I lease-to-own with Snap?

Our lease-to-own financing works with partners that sell furniture, mattresses, tires and wheels, appliances, electronics, and other durable goods. Please visit our Store Locator at snapfinance.com to find a Snap Partner near you.

Disclosures

Snap-branded product offering includes retail installment contracts, bank installment loans, and lease-to-own financing. Talk with your local Snap sales representative for more details on which product qualifies at your store location. For more detailed information, please visit https://snapfinance.com/legal/products

1 Not all applicants are approved. While no credit history is required, Snap obtains information from consumer reporting agencies in connection with submitted applications, and your score with those agencies may be affected.

2 Average approval amounts vary across product types and range from $300 to $5,000. Subject to underwriting qualification criteria.