eBook & Research library

Explore our extensive library of ebooks, crafted to help business owners like you grow and succeed. From the latest trends and data-driven strategies to practical solutions for enhancing financial accessibility, our ebooks cover a range of topics to help you stay informed and make strategic decisions.

Closing the credit gap: 2026 outlook study

How credit shapes shopping behaviors, personal finances, and expectations for the year ahead – and what it means for your business.

Closing the credit gap: Major purchase study

What businesses need to know about shoppers with low or subprime credit.

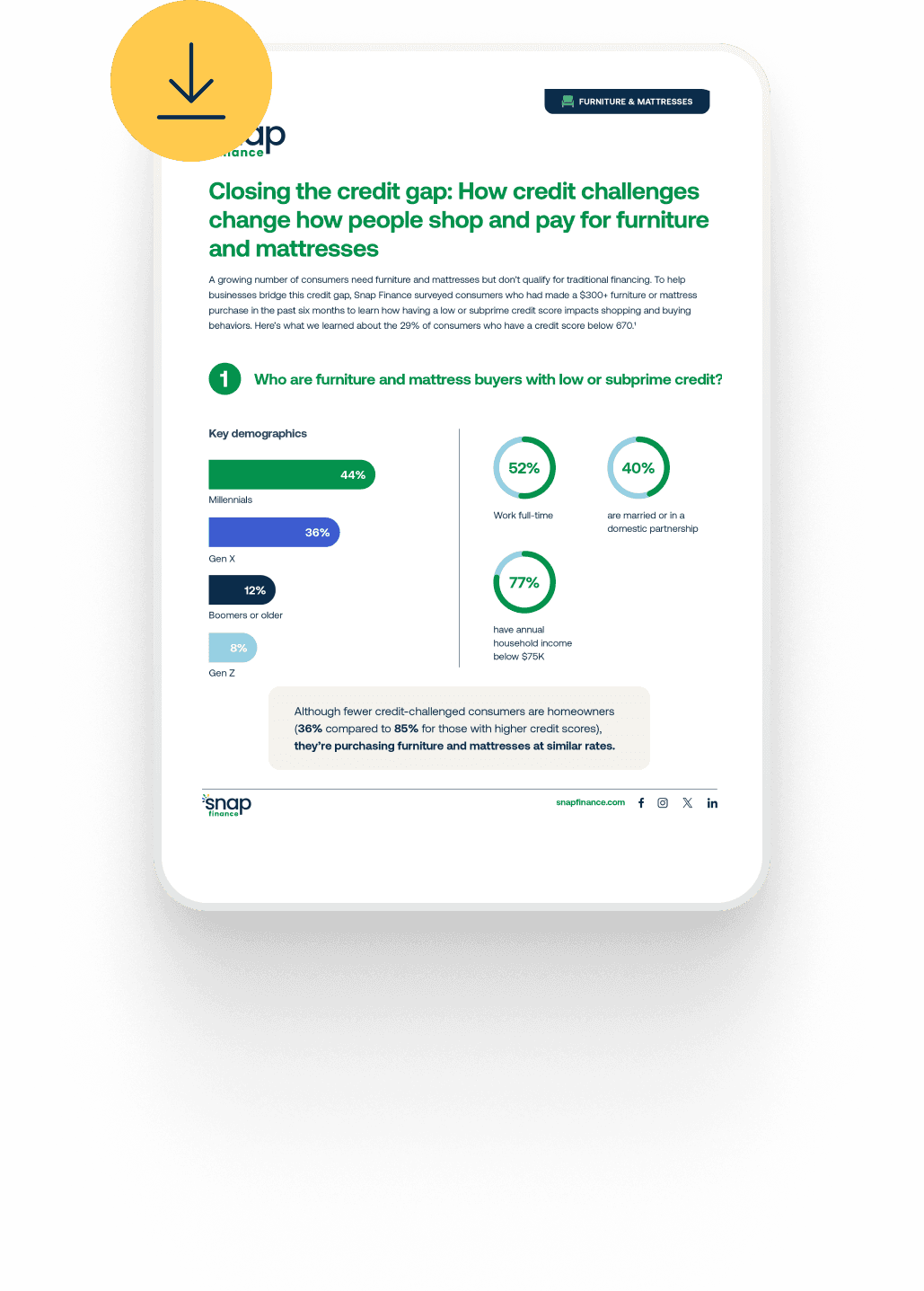

Closing the credit gap: Shopping and paying for furniture and mattresses with credit challenges

A growing number of consumers need furniture and mattresses but don’t qualify for traditional financing. New research from Snap Finance uncovers insights to help businesses better understand and serve credit-challenged furniture and mattress shoppers.

2025 subprime financing study

How and why do small businesses use subprime or tertiary financing, including installment loans and lease-to-own financing? New research from Snap Finance explores the impact of inclusive financing – and how businesses like yours can better reach the subprime market. Download our 2025 subprime financing study to learn more.

Meeting the needs of consumers with credit challenges

How does having low or subprime credit change how people shop and pay? New research from Snap explores the real-life impact of credit challenges on consumer preferences and behaviors. Download Snap’s second annual look at credit-challenged consumers to learn more about this important customer segment.

How to grow a business: strategies for enterprise growth

While there’s no guaranteed path to enterprise growth, there are proven strategies to help you scale and grow your business. From improving business processes to reaching new audiences, there are steps you can take now to take your enterprise to the next level. Read our ebook to learn more.

Exploring the potential of the subprime furniture retail market

Customers with low or subprime credit scores often struggle to secure financing for major purchases. In this comprehensive ebook, Snap Finance’s exclusive research reveals how these credit difficulties shape furniture shopping behaviors and financing options. Delve into the strategies and insights that can help you attract and convert consumers with credit challenges, unlocking new avenues for growth and engagement.

Insights into how and why small businesses offer tertiary financing

Is your business missing out on sales because customers don’t qualify for traditional financing Tertiary financing options like installment loans and lease-to-own plans can bridge that gap, helping more shoppers get what they need while boosting your sales.

Discover how credit-challenged consumers navigate mattress purchases

Is your business tapping into the potential of credit-challenged customers? These customers often face unique challenges when making major purchases like mattresses. Understanding their shopping and purchasing behaviors can help you provide the right financing options to close more sales and build stronger relationships with these subprime borrowers.

Decoding Gen Z - how they think and shop

Known as “digital natives,” Gen Z was born into a world of rapid technological advancement and unprecedented access to information. As they continue to gain purchasing power, Gen Zers are reshaping the retail landscape in profound ways. Understanding their behaviors, preferences, and values has never been more important for retailers. Get ready to uncover the Gen Z consumer, so you can position your business for growth and relevance.

Close the sale with lease-to-own financing

Lease-to-own financing can help many customers, including those with less-than-ideal credit, get what they need. It can also help you grow incremental sales, reach more customers, and increase order value - all while providing customers with extra spending power. Read our new ebook to learn how lease-to-own financing can help you close the sale.

How low credit scores impact access to auto services

Did you know that 29% of customers with low credit scores could not have paid for their auto service or repair without financing?¹ To better understand the impact of having a lower credit score, Snap Finance asked credit-challenged customers how they shop and pay for auto services. Learn more about our findings in this new research fact sheet.

Understanding the far-reaching impact of credit challenges

Having a low or subprime credit score changes the financial health and money habits of your customers. We asked consumers with credit scores below 670 about their setbacks, the financial products they use, and their current financial situation. Find out what we learned.

Turbocharge your retail sales by offering third-party financing: Increase revenue with pay-over-time options for more credit types

Traditional financing may be out of reach for many of your customers. Offering alternative third-party financing can help more customers get what they need now, while delivering new opportunities, increased sales, and a competitive edge for your business.

Key considerations when choosing a POS financing partner: Setting your business up for success

Reach more customers and close more sales with point-of-sale (POS) financing. Read our latest guide to learn how to choose the right POS financing partner for your business.

How income shapes consumer behaviors and economic views

Households across all income levels are feeling the effects of an uncertain economy and re-evaluating their approaches to spending and personal finances. Snap Finance surveyed consumers to better understand how having a lower income influences their shopping behaviors, personal finance habits, and economic outlook. What we learned can help your business better understand and serve customers in every income bracket.

Boost sales with lease-to-own financing: Empower more customers to get what they need now

Reach more customers and close more sales with point-of-sale (POS) financing. Read our latest guide to learn how to choose the right POS financing partner for your business.

Tapping in to an untapped market: An in-depth look at consumers with credit challenges

Customers with low or subprime credit scores are shopping in your store. Are they leaving empty-handed?

Recent research from Snap Finance shows having low credit or no credit changes how customers shop and pay for what they need. Read our ebook to discover how offering pay-over-time solutions to credit-challenged customers can help you expand your customer base and increase sales.

How households are shopping, spending, and paying for the holidays

Holiday shoppers are making plans for the season, from where and what they’ll buy to how much they’ll spend. Snap Finance surveyed consumers to better understand their holiday shopping and spending habits and how factors including income and age influence those behaviors and preferences. Find out what we learned.

Redefining retail: Adapting to the changing ways people shop for furniture

From e-commerce to augmented reality, how customers shop and pay for furniture and what they buy is changing. Businesses that respond to these industry shifts and furniture trends, including offering furniture financing, are better positioned to thrive in this evolving market. Read our ebook to learn the impact of the housing market, furniture trends, technology, and generational shifts on your business.