Closing the credit gap: Shopping and paying for furniture and mattresses with credit challenges

A growing number of consumers need furniture and mattresses but don’t qualify for traditional financing. New research from Snap Finance uncovers insights to help businesses better understand and serve credit-challenged furniture and mattress shoppers.

Key insights from new Snap Finance research

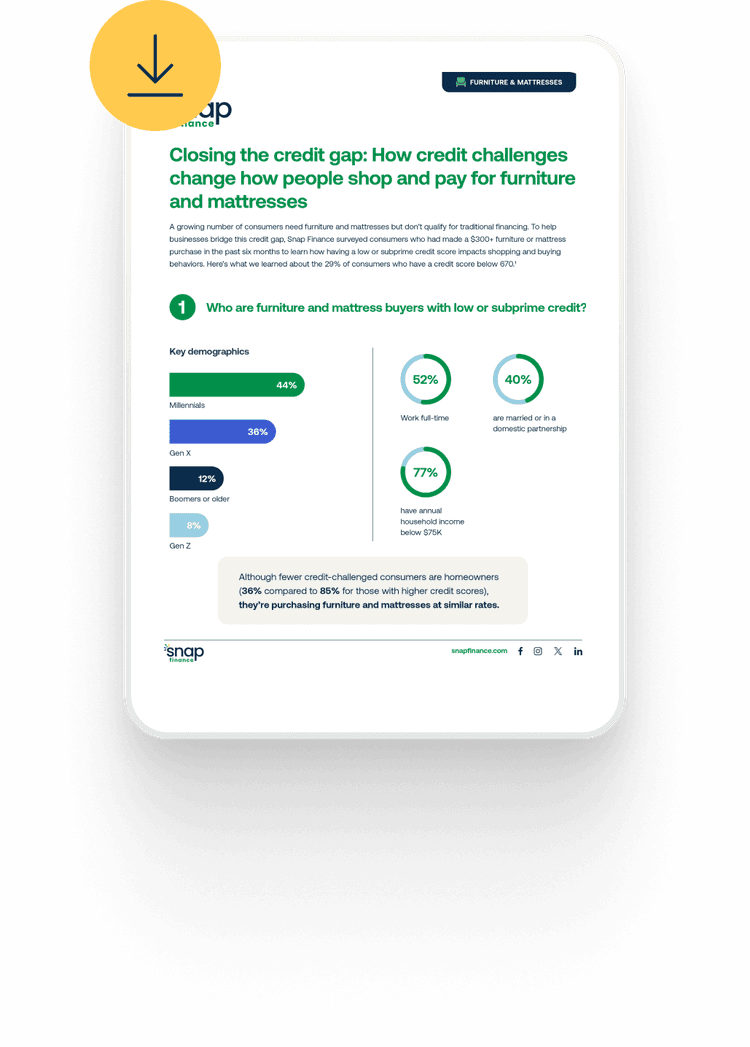

Among consumers with credit scores below 670:

66%

said financing availability was important in choosing where to buy

46%

could not have paid for their purchase without financing

13%

used lease-to-own financing to get their furniture or mattress

Takeaways for your business

Financing drives furniture and mattress sales

Financing makes many furniture or mattress purchases possible – and helps shoppers get more or better quality merchandise.

53% spent more because financing was available, among furniture and mattress shoppers with lower credit scores.

Necessity fuels furniture and mattress purchases

Our study found that credit-challenged consumers are more likely to shop out of necessity – when the sofa is in damaged or the mattress is shot.

44% made a purchase to replace furniture or a mattress in disrepair, among those with lower credit scores.

Credit guides furniture and mattress purchasing decisions

When shopping for furniture and mattresses, those with lower credit scores say price and ease of purchase are important factors in choosing where to buy.

26% of credit-challenged shoppers purchased a lower quality mattress or furniture due to their financial situation

More time to pay means more business for you

Increased revenue

Reach more customers and close more sales with our strong approval rates1

Supercharged sales

58% of credit-challenged consumers spent more because financing was available2

Expanded reach

Target new and repeat business and generate revenue with our preapproved leads

Fast funding

Enjoy expedited payments, typically within two business days of merchandise delivery or completed invoice

Disclosures

Snap-branded product offering includes retail installment contracts, bank installment loans, and lease-to-own financing. For more detailed information, please visit snapfinance.com/legal/products

Findings based on proprietary research conducted through Accelerant Research’s Agora panel with 2,736 household are financial decision makers who made a $300+ purchase in the prior 6 months across 14 product categories. Snap Finance, August 2025.

1Not all applicants are approved. Approvals subject to underwriting qualification criteria.

2Merchant Pulse Study. Snap Finance, 2023.